Yes, you may post CGST / IGST / SGST in separate accounts for the Annual return

entries.

Step-by-step guidelines are as under: –

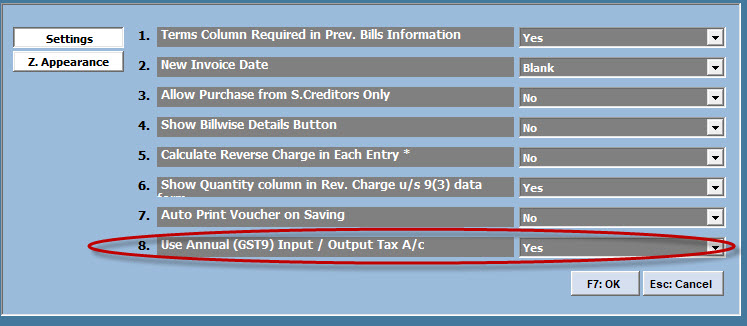

1. A setting to implement this feature is available in GST Docs -> Purchase (see pic 1). If you want to implement this feature from FY 2017-18, choose ‘Yes’ and if you want to implement this feature from FY 2018-19, choose ‘W.e.f. 2018-19’. Default is ‘W.e.f. 2018-19’.

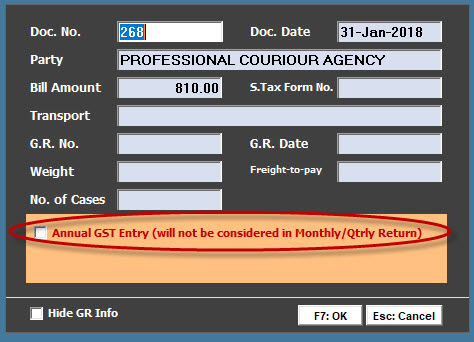

2. To mark entries for Annual return, click ‘F5: Others’ -> Fill Tax / G.R. Info. You may then check ‘Annual GST Entry’ check box (see pic 2). Once you check this check box, you will be prompted to mention the supply date.

3. This setting works in the like manner in case of debit / credit notes.