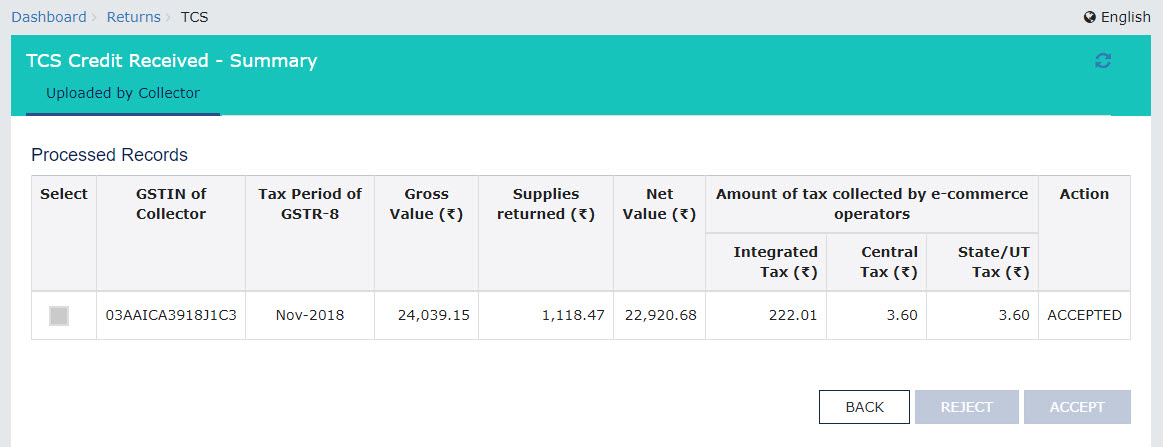

E-Commerce operators are required to collect IGST @ 1% or CGST / SGST @ 0.5% each w.e.f. 01/10/2018. The amount collected during a month shall be deposited by the e-commerce operator to the department by the 7th of next month. Once the amount is deposited by the e-commerce operator, you can see the details on GST Portal by clicking on Dashboard -> File Returns -> Choose Month -> “TDS and TCS credit received”. You will see the information as shown in pic 1.

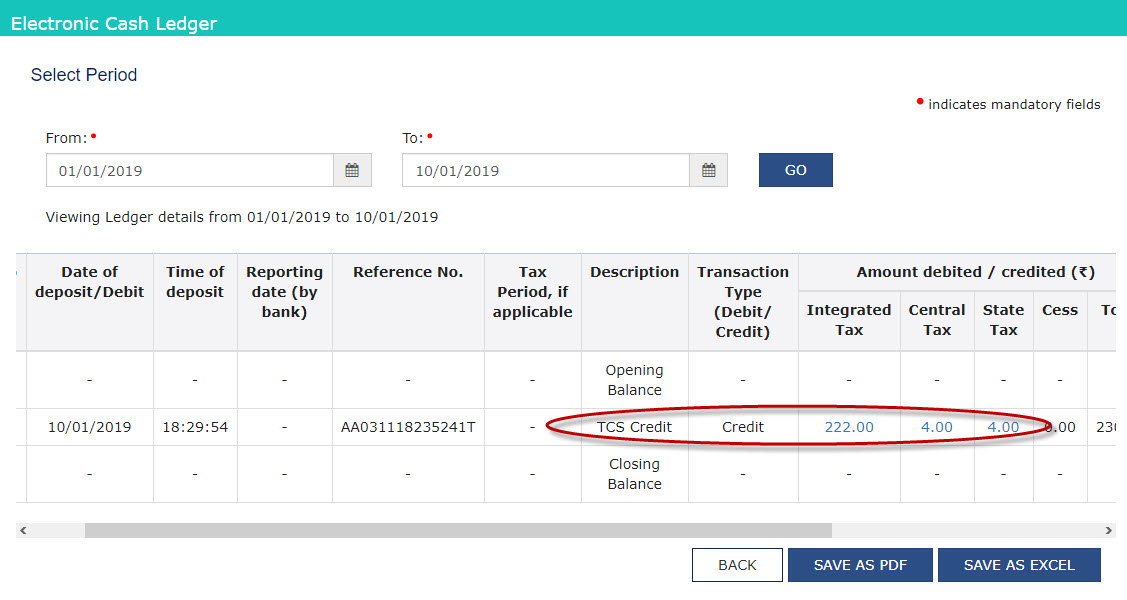

After verifying the details, you should click on “Accept” button as shown in pic 1. After this, you need to file this return by submitting and signing the same. Once it is done, you will get credit in your Cash Ledger on the same date. Credit shall appear as shown in pic 2.

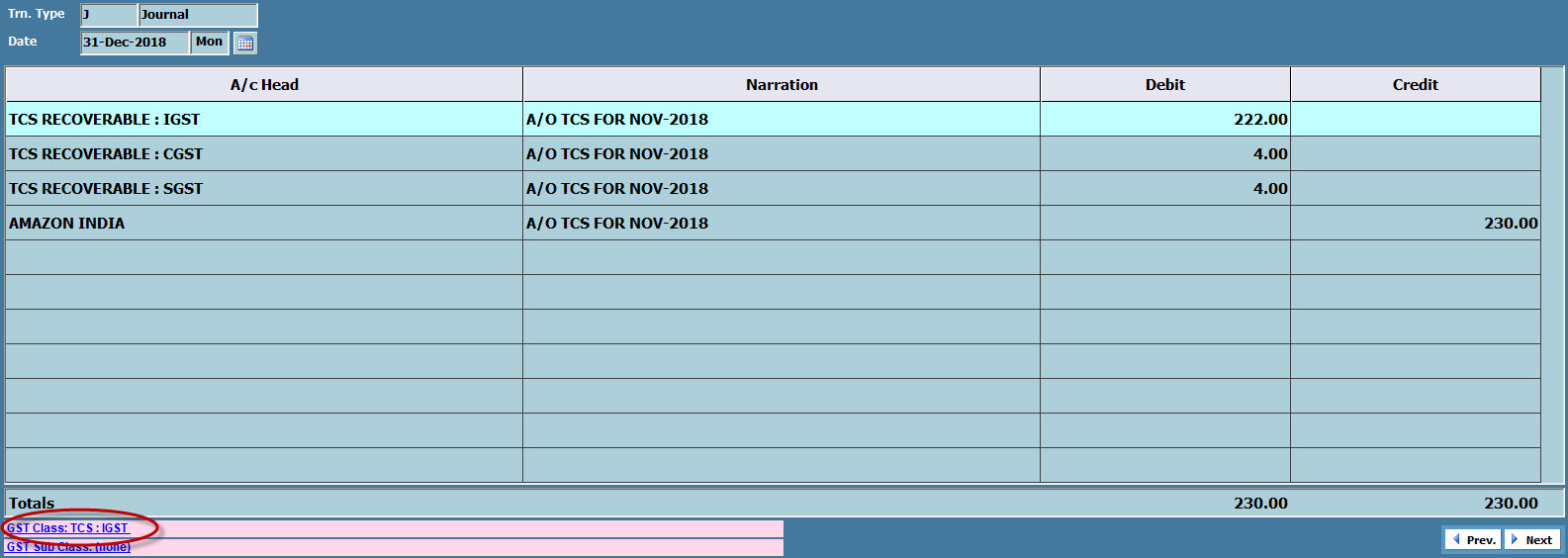

You should pass a journal entry on the last date of the month in which you want to avail credit in GSTR-3B. e.g. If you are filing GSTR-3B for the month of December-2018 on 20/01/2019, you should pass the entry on 31/12/2018. The entry should be passed as shown in pic 3.

Please

note that account heads of IGST / CGST / SGST should be marked with the relevant

GST Class. GST Class for IGST is visible in the Voucher shown in pic 3. Amount

of TCS shall be picked up from this voucher and shall be reflected in your

GSTR-3B.